The MJM 35 is the ideal day/weekender yacht – Arriving at McMichael Yacht Yards & Brokers in February.

A recent survey of American boaters shows that their pattern of year-over-year spending growth reported for 2024 vs. 2023 will continue into 2025. This information should allow the boating industry as well as boating enthusiasts to enter the new year with a positive, encouraging perspective.

Padin & Estabrook LLC, an independent marketing and research firm, reported on its boaters’ usage and attitude study they did for McMichael Yacht Yards & Brokers (Mamaroneck, NY) with the cooperation of WindCheck Magazine and Kyle Media. This survey had 819 respondents and was conducted in 2024 before the recent election and does not reflect any influence of the current administration’s economic positions. The study was conducted in multiple waves with the final results reported in September 2024.

“This is a study of a slice of the U.S. economy: owners of sail and power boats in the northeast. As such, it is not projectable to the overall U.S. economy, but rather the specific marketplace being served by yacht manufacturers, yacht brokers, yacht service yards, and associate boating businesses in the northeast. In addition, the data shows that those who responded are experienced, passionate boaters who continue to invest in their boating endeavors,” noted Ed Padin, Partner, Padin & Estabrook LLC. “The data and verbatim responses indicate that these respondents view their boats as assets that enable them to engage in boating; as such, they are willing to spend what it takes to maintain or enhance their boats,” Padin concluded.

SURVEY SAMPLE

This study was conducted online with invitations sent to the McMichael customer database as well as subscriber lists of Windcheck Magazine and Kyle Media, owners of Great Lakes Scuttlebutt, The Marine Ad Network, and Latitudes & Attitudes magazine.

The survey sample skewed heavily towards experienced boaters, with over 90% reporting having over 20 years of on-the-water experience. Further, they are boating many days per month during the season. This datapoint supports the earlier assumption that this respondent base is comprised of a sliver of the country made up of passionate boaters.

| For how many years have you been boating? | % Respondents |

| <5 years | 4% |

| 5-10 years | 2% |

| 11-15 years | 2% |

| 16-20 years | 2% |

| 20+ years | 91% |

| Total | 100% |

| Number of days on the water per average summer month. | % Respondents |

| 1-5 | 13% |

| 6-10 | 29% |

| 11-15 | 26% |

| 16-20 | 14% |

| 20+ | 18% |

| Total | 100% |

The sample base also is reflective of sailors and power boaters, alike.

| Boat Ownership | % Respondents |

| Sail only | 38% |

| Power only | 32% |

| Sail and Power | 14% |

| Non-owning boaters (influencers) | 16% |

| Total | 100% |

| 84% |

And 84% consider boating a very or most important non-work activity.

| Importance of boating vs. other activities | % Respondents |

| Most important | 27% |

| Very important | 57% |

| Moderately important | 12% |

| Not very important | 3% |

| Not at all important | 1% |

| Total | 100% |

Respondent verbatim comments:

- Boating is my lifestyle, it’s not just a hobby.

- Given the investment in the boat and associated costs, it has to be the priority when possible.

- Boating has always been a big part of my life. Owned my first boat at age 8. So many shared memories over my 60 years plus of boating with family and friends!

- – We focus on boating during the season and try to take full advantage of the brief time we have.

Looking at this data and reading these and many other comments provided, it is clear that these are avid boaters and, like avid participants in many sports, they will spend what is needed to buy, maintain, and enjoy their time and financial investments in boating. Supporting this assumption are the following trend points gathered on year-over-year personal spending on boating:

The new J/40 continues to rake in awards – available at McMichael Yacht Yards & Brokers.

SPECIFIC FINDINGS

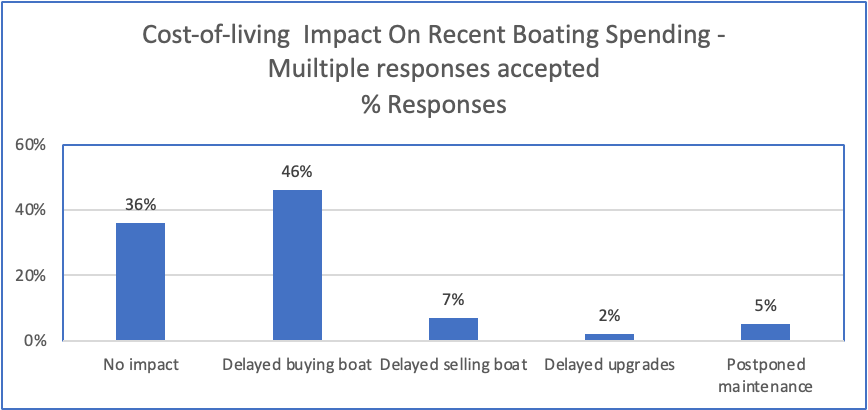

Impact of recent years’ cost of living increases on boating spending

Over a third of respondents said recent economic factors had little or no impact on their boating expenditures while almost half said they postponed purchasing a new boat, retaining their current boat.

Respondent verbatim comments:

- Boating has always been considered a necessary expense and has always been expensive. My operating and purchase expenses are just considered ‘normal.’

- I view the amount of money I invest in fuel as money well spent. There’s no point in owning a boat, if it’s just going to sit on a mooring.

- The cost of boating is factored into our life.

- Except for increases in dockage, no impact.

Boating Spending 2024 vs. 2023

Reflecting the pattern of increasing operating and maintenance cost increases, 43% spent more in 2024 than 2023—not always gladly as some comments indicate. Only 14% managed to spend less.

Respondent verbatim comments:

- I bought a new boat.

- Boating has always been considered a necessary expense.

- The price of boat parts is just nuts and transient dockage will keep folks at home. Even the very wealthy will balk at giving someone that amount of money for a night’s stay.

- Boatyard fees, new sails, materials for maintenance, etc., all increase yearly, regardless of current inflation pressures.

- Gas major component of cost of operation.

- I am only spending the necessary money – no frills.

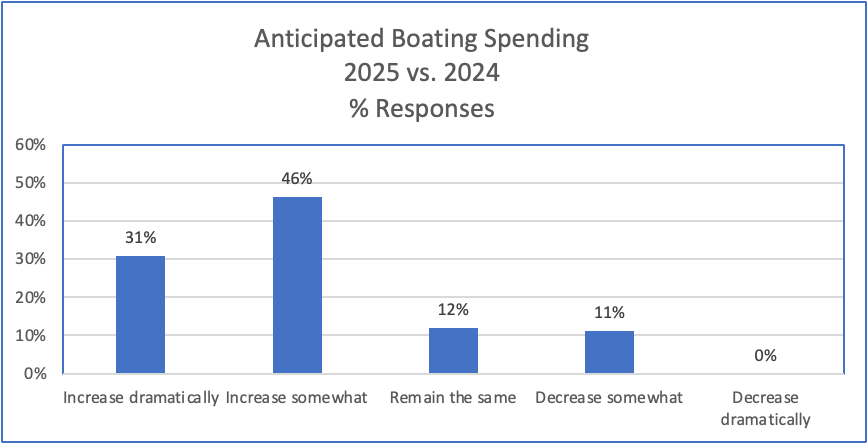

Projected 2025 Boating Spending Levels

Looking ahead, 77% of respondents indicated they anticipate spending more on boating next year…a third dramatically more. Some of these increases will be on the more “mandatory” areas (deferred maintenance, cost of living increases, dockage, etc.) whereas others will be increases in discretionary spending, so the boater is able to continue to enjoy time on the water with friends and family.

Respondent verbatim comments:

- Costs beyond my control may increase, insurance, boat club, travel costs.

- To stay competitive sailing, yearly upgrades are a must and prices keep rising.

- I like my time in the water with families and friends like I said it’s vacation recreation time if I was away, I’d be paying money for hotels and lodging.

- As costs rise and our disposable income falls. We well probably spend the same amount of time or more on the boat, but definitely defer on as much spending as possible.

- Look at the cost of everything else…it’s not going to get any cheaper!

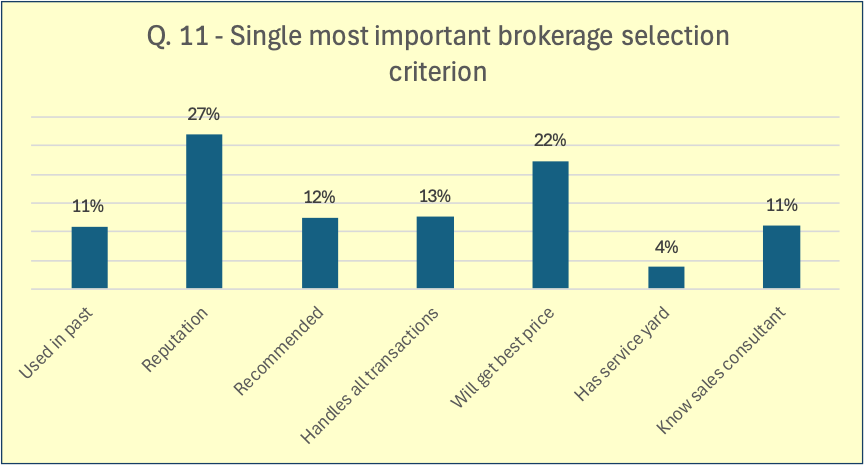

Yacht Brokerage and Service Yard Selection Criteria

Respondents were asked to rate how important various criteria for selecting a yacht brokerage or service yard. In both instances, respondents said they rely most heavily on the company’s overall reputation more than any other factor. For brokerages, the second strongest factor was confidence in getting the best price for a purchase or sail of a boat. Surprisingly, likely drivers like past experience, recommendations, and personal relationship with a broker were tertiary.

In terms of selecting a yacht service yard, reputation again was the highest rated factor, again trumping being recommended or past use. However, those two later factors were much stronger influences in yard selection than choosing a brokerage.

In reviewing the verbatim responses provided, overall reputation is earned by service providers whose marketplace longevity has fostered experienced, skilled, and provide gold standard sales and service process that guarantee superior outcomes.

To view all the data from this study, go to https://mcmichaelyachtbrokers.com/wp-content/uploads/2024-Boaters-Survey-Data-Deck-012425.pdf